#finance mobile app

Explore tagged Tumblr posts

Text

#best mobile finance app#daily finance app#good finance apps#new finance app#apps to help with finances#finance mobile app

0 notes

Text

Chime Mobile Banking: A Better Way to Bank

In today’s fast-paced world, who has time to wait in line at a traditional bank or deal with outdated services? Enter Chime, the mobile banking solution designed for the modern lifestyle. With Chime, you can manage your money with ease, anywhere, anytime—right from your phone. Here’s why millions are switching to Chime:

No Hidden Fees—Ever

Most traditional banks hit you with fees left and right. Maintenance fees, minimum balance fees, overdraft fees—it adds up quickly. But with Chime, you’ll never pay a monthly fee or a fee for minimum balances. Plus, there’s no foreign transaction fees, so you can travel the world worry-free. Say goodbye to hidden fees and hello to real savings.

Get Paid Up to Two Days Early

Waiting for payday can be stressful, especially when bills are due. Chime makes payday something to look forward to by giving you access to your direct deposit up to two days early. Whether it's your paycheck or government benefits, Chime puts your money in your hands faster so you can pay bills, save, or treat yourself sooner.

Fee-Free Overdrafts

We've all been there—an unexpected purchase puts your account in the negative, and your bank slaps you with an overdraft fee. Chime’s SpotMe feature lets you overdraft up to $200 with no fees. It’s simple, straightforward, and designed to give you peace of mind when you need it most.

A Seamless Digital Experience

Chime isn’t just a bank—it’s an all-in-one financial tool. The user-friendly app lets you easily track your spending, deposit checks, transfer money, and receive instant notifications for transactions. With 24/7 access, your finances are always at your fingertips. Need to find an ATM? Chime has over 60,000 fee-free ATMs in its network, more than most traditional banks.

Save Effortlessly

Chime’s Automatic Savings feature helps you build your savings effortlessly. Every time you use your Chime card, we’ll round up your purchase to the nearest dollar and transfer the difference into your Savings Account. It’s a painless way to grow your savings over time. Plus, you can set up automatic transfers to reach your financial goals even faster.

Security You Can Count On

With FDIC insurance up to $250,000, Chime ensures that your money is safe and secure. Our state-of-the-art security measures protect your account, while features like instant transaction alerts and the ability to instantly block your card provide peace of mind.

Join the Chime Revolution Today

Traditional banks are outdated and expensive, but Chime is the future of banking. With no hidden fees, early paydays, and powerful tools to help you manage your money, it’s no wonder Chime is trusted by millions of people nationwide. Ready to upgrade your banking experience? Follow the link below to download the Chime app and open your account in just minutes—all from your phone.

Switch to Chime today and experience the smarter, easier, and more affordable way to bank.

Download Chime Mobile App Now, And Earn $100! Terms apply.

#Chime#Mobile Banking#mobile banking account app#mobile banking application#mobile#iphone#ios#android#android apps#Chime Mobile Banking#banking mobile upi#banking app#online banking#banking#financial#finance#financial services

3 notes

·

View notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#fd account#upi account#fixed deposit account#contactless banking#upi bank app#upi bank#secure net banking#safe mobile banking#mobile app#e banking app#mobile banking apps in india#internet banking app#e banking#kyc bank account#ebanking#digital banking india#paise check karne wala app#bank fd rates#account check karne wala app#khata check karne wala app#finance application#upi mobile banking#banking mobile upi#mobile banking upi#mobilebanking app upi#app upi mobile banking#net banking app upi#upi mobile banking app#upi net banking app#upi transaction app

2 notes

·

View notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#upi money transfer app#upi registration#bank fixed deposit#highest fd rates in bank#fd bank#upi application#paise check karne wala app#upi app#upi payment bank app#digital money transfer#finance app#bank fd rates#best fd rates in bank#online money transfer app#scan for mobile payment#best cash transfer apps#bank balance check karne ka app#check bank account balance#highest fd interest rate bank#bank balance check karne wala app

2 notes

·

View notes

Text

How To Develop A Fintech App In 2024?

FinTech, short for financial technology, represents innovative solutions and products that enhance and streamline financial services. These innovations span online payments, money management, financial planning applications, and insurance services. By leveraging modern technologies, FinTech aims to compete with and often complement traditional financial institutions, improving economic data processing and bolstering customer security through advanced fraud protection mechanisms.

Booming FinTech Market: Key Highlights And Projections

Investment Growth In FinTech

In 2021, FinTech investments surged to $91.5 billion.

This represents nearly double the investment amount compared to 2020.

The significant increase highlights the rapid expansion and investor interest in the global FinTech market.

Projected Growth In Financial Assets Managed By FinTech Companies

By 2028, financial assets managed by FinTech firms are expected to reach $400 billion.

This projection indicates a 15% increase from current levels, showcasing the potential for substantial growth in the sector.

Usage Of Online Banking

About 62.5% of Americans used online banking services in 2022.

This figure is expected to rise as more consumers adopt digital financial services.

Key FinTech Trends In 2024

1. Banking Mobility

The transition from traditional in-person banking to mobile and digital platforms has been significantly accelerated, especially during the COVID-19 pandemic. The necessity for remote banking options has driven a surge in the adoption of smartphone banking apps. Digital banking services have become indispensable, enabling customers to manage their finances without needing to visit physical bank branches.

According to a report by Statista, the number of digital banking users in the United States alone is expected to reach 217 million by 2025. Many conventional banks are increasingly integrating FinTech solutions to bolster their online service offerings, enhancing user experience and accessibility.

2. Use Of Artificial Intelligence (AI)

AI in Fintech Market size is predicted at USD 44.08 billion in 2024 and will rise at 2.91% to USD 50.87 billion by 2029. AI is at the forefront of the FinTech revolution, providing substantial advancements in financial data analytics, customer service, and personalized financial products. AI-driven applications enable automated data analysis, the creation of personalized dashboards, and the deployment of AI-powered chatbots for customer support. These innovations allow FinTech companies to offer more tailored and efficient services to their users.

3. Development Of Crypto And Blockchain

The exploration and integration of cryptocurrency and blockchain technologies remain pivotal in the FinTech sector. Blockchain, in particular, is heralded for its potential to revolutionize the industry by enhancing security, transparency, and efficiency in financial transactions.

The global blockchain market size was valued at $7.4 billion in 2022 and is expected to reach $94 billion by 2027, according to MarketsandMarkets. These technologies are being utilized for improved regulatory compliance, transaction management, and the development of decentralized financial systems.

4. Democratization Of Financial Services

FinTech is playing a crucial role in making financial services more transparent and accessible to a broader audience. This trend is opening up new opportunities for businesses, retail investors, and everyday users. The rise of various digital marketplaces, money management tools, and innovative financing models such as digital assets is a testament to this democratization.

5. Products For The Self-Employed

The increasing prevalence of remote work has led to a heightened demand for FinTech solutions tailored specifically for self-employed individuals and freelancers. These applications offer a range of features, including tax monitoring, invoicing, financial accounting, risk management, and tools to ensure financial stability.

According to Intuit, self-employed individuals are expected to make up 43% of the U.S. workforce by 2028, underscoring the growing need for specialized financial products for this demographic. FinTech companies are responding by developing apps and platforms that address the unique financial needs of the self-employed, facilitating smoother and more efficient financial management.

Monetization of FinTech Apps

1. Subscription Model

FinTech apps can utilize a subscription model, which offers users a free trial period followed by a recurring fee for continued access. This model generates revenue based on the number of active subscribers, with options for monthly or annual payments. It ensures a steady income stream as long as users find the service valuable enough to continue their subscription.

2. Financial Transaction Fees

Charging fees for financial transactions, such as virtual card usage, bank transfers, currency conversions, and payments for third-party services, can be highly lucrative. This model capitalizes on the volume of transactions processed through the app, making it a significant revenue generator.

3. Advertising

In-app advertising can provide a consistent revenue stream. Although it may receive criticism, strategically placed banners or video ads can generate substantial income without significantly disrupting the user experience.

Types Of FinTech Apps

1. Digital Banking Apps

Digital banking apps enable users to manage their bank accounts and financial services without visiting a physical branch. These apps offer comprehensive services such as account management, fund transfers, mobile payments, and loan applications, ensuring transparency and 24/7 access.

2. Payment Processing Apps

Payment processing apps act as intermediaries, facilitating transactions between payment service providers and customers. These apps enhance e-commerce by enabling debit and credit card transactions and other online payment methods, supporting small businesses in particular.

To Read More Visit - https://appicsoftwares.com/blog/develop-a-fintech-app/

#app development#finance app development#finance app#real estate app development#mobile app development#fintech apps

2 notes

·

View notes

Photo

MobioSolutions team of industry experts uses advanced technology and deep domain knowledge to provide smooth, secure, and efficient Fintech solutions. Whether it's integrating robust security protocols, ensuring seamless transaction processes, or driving innovative, user-friendly features, we're on the frontline of transforming financial technology. Join us on this exciting journey and learn how we're paving the way for a better Fintech future.

#finance#fintech#FinServ#financialservices#mobile#web#app#development#fintechindustry#security#technology#future#mobiosolutions#uk

10 notes

·

View notes

Text

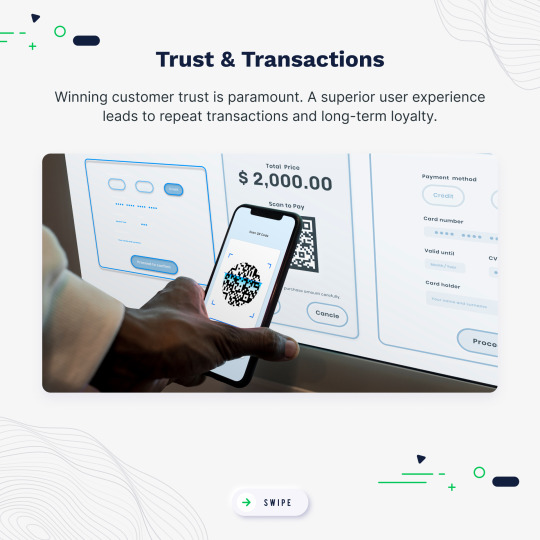

Struggling to keep your app users coming back? Swipe left to uncover the magic of Fintech in boosting customer loyalty! Discover how a Fintech app can turn those retention woes around and create a community of loyal users who can’t wait to log back in. Your solution to building lasting relationships is just a slide away! 🔄📲

#user interface#finance#banking#fintech#apps#innovation#customer loyalty#customer engagement#trends#mobile payments#mobiosolutions

2 notes

·

View notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Download app:

#upi app download#upi earning app#download upi app#create new upi id#banking upi mobile#upi mobile banking#banking mobile upi#upi bank account#mobile banking upi#mobilebanking app upi#upi khata#secure upi#app upi mobile banking#net banking app upi#secured upi#upi transfer app#upi account number check#upi mobile banking app#upi net banking app#finance upi#upi transfer to bank account#finance upi deposit#upi transaction tracking#finance upi online#upi from credit card#finance upi apps#upi investment#finance upi mandate#upi create#finance upi app

0 notes

Text

#personal finance management app#financial management apps#finance mobile app#apps to help with finances

0 notes

Text

Fintech has significantly altered how the finance industry works. Established fintech institutions along with start-ups are in the limelight of the industry. This is faced as a challenge by the traditional financial institutions as people used to depend on them for money transfers and transactions. However, with the development of fintech, people can go online and carry out their financial activities like making payments, money transfers, etc., from their mobile or computers. Fintech innovations have enabled people to have better control over their financial lives which results in the increase of financial literacy and empowerment.

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Download App:

#bank balance check karne wala app#check my bank balance#check bank balance app#upi app download#finance application#balance check karne wala app#latest fd rates#banking mobile upi#upi bank account#app upi mobile banking#net banking app upi#upi transfer app#upi account number check

1 note

·

View note

Text

Why Finance Apps are the Future of Digital Financial Management

In today’s fast-paced digital age, the financial industry is undergoing a major transformation, with finance apps leading the charge. These applications have revolutionized how people manage their money, offering convenience, accessibility, and personalization like never before. From banking and investing to budgeting and bill payments, finance apps are reshaping how individuals and businesses handle their finances. The shift towards digital financial management has accelerated in recent years, driven by advances in technology, changing consumer expectations, and the demand for greater financial transparency and control.

In this blog, we’ll explore why finance apps are the future of digital financial management, highlighting key trends, features, and the immense value they bring to consumers and businesses alike.

1. The Convenience of On-the-Go Financial Management

One of the biggest reasons finance apps are the future of digital financial management is their ability to offer unparalleled convenience. With smartphones now an essential part of everyday life, finance apps allow users to access their financial information anytime and anywhere. Whether it's checking account balances, transferring money, paying bills, or monitoring investments, finance apps put control in the hands of users, eliminating the need for trips to a physical bank or financial institution.

Mobile banking has become increasingly popular, and according to reports, a vast majority of banking customers use mobile banking apps. This shift to mobile financial management shows no signs of slowing down, as consumers increasingly value speed and ease of access. In a world where time is a precious commodity, finance apps help people stay on top of their financial matters while on the move, creating a seamless experience.

2. Enhanced Financial Control and Transparency

Finance apps have made it easier than ever to stay informed and in control of one’s financial health. Traditional banking services often required waiting periods to receive statements or visit a branch for inquiries. Now, with finance apps, users can monitor every transaction in real-time, set budgets, track expenses, and receive notifications about their spending patterns. These features offer a level of transparency that is critical for effective financial management.

Moreover, many finance apps incorporate tools like spend analysis, automated savings, and bill reminders, empowering users to make smarter financial decisions. This proactive approach helps individuals avoid unnecessary fees, overspending, or missed payments. In short, finance apps provide the real-time insights and tools needed to manage finances responsibly and efficiently, all from the palm of their hand.

3. Personalized Financial Solutions

One of the standout benefits of finance apps is the ability to offer personalized financial solutions. Unlike traditional financial institutions that often provide a one-size-fits-all approach, finance apps use data analytics and machine learning algorithms to tailor financial advice, products, and services to the unique needs of each user.

For example, budgeting apps can analyze spending habits and suggest ways to save money or reduce expenses. Investment apps can recommend portfolios based on a user’s risk tolerance, financial goals, and investment preferences. Many finance apps even allow users to set custom financial goals, such as saving for a vacation, paying off debt, or building an emergency fund, and then provide recommendations and progress tracking.

This level of personalization makes finance apps more engaging and effective, helping users achieve their financial goals faster and with greater confidence.

4. AI and Automation Revolutionizing Financial Management

Artificial Intelligence (AI) and automation are key drivers in the evolution of finance apps, making them smarter and more intuitive than ever before. AI-powered features such as chatbots, predictive analytics, and automated financial planning are streamlining the way users interact with their finances.

For instance, AI-driven chatbots are now common in banking and financial apps, providing customer support 24/7 and answering frequently asked questions in real time. These virtual assistants can guide users through various financial processes, such as opening an account, applying for loans, or even making investment decisions.

Automation has also taken over routine tasks, such as automatic bill payments, recurring savings transfers, and investment rebalancing. By eliminating the need for manual intervention, finance apps help users stay on top of their financial obligations effortlessly. This level of automation not only improves financial management but also reduces the risk of human error and missed deadlines, enhancing overall financial well-being.

5. Improved Security and Fraud Detection

With the rise of digital finance comes the increasing need for robust security measures. Finance apps are leading the way in adopting cutting-edge security technologies to protect user data and transactions. Features like biometric authentication (such as fingerprint or facial recognition), multi-factor authentication (MFA), and encryption ensure that sensitive financial information is safeguarded from unauthorized access.

In addition to these security measures, many finance apps incorporate AI-driven fraud detection systems. These systems analyze transaction patterns in real-time and flag any suspicious activities, alerting users immediately if something unusual occurs. This proactive approach to security helps prevent fraud and gives users peace of mind knowing that their finances are secure.

As cyber threats continue to evolve, finance apps will play a crucial role in protecting digital financial management, making them indispensable tools for consumers and businesses alike.

6. Inclusive Access to Financial Services

Finance apps are democratizing access to financial services, particularly for those who are underbanked or unbanked. In many parts of the world, traditional banking services are inaccessible due to a lack of infrastructure or prohibitive fees. However, mobile finance apps are changing that by offering low-cost, accessible solutions to manage money, make payments, and even access credit.

For instance, digital wallets and peer-to-peer payment apps have enabled millions of people in emerging markets to participate in the formal financial system. Micro-investing apps have also allowed users with limited funds to start investing, which was once a luxury reserved for wealthier individuals.

This inclusivity is a game-changer for global financial equity, helping more people gain control of their finances and improving overall economic stability. As mobile technology continues to penetrate underserved areas, finance apps will play an even greater role in bridging the financial inclusion gap.

7. Integration with Broader Financial Ecosystems

Another reason finance apps are shaping the future of financial management is their integration with broader financial ecosystems. Many finance apps are designed to work seamlessly with other apps and services, allowing users to have a holistic view of their financial health.

For example, users can link their budgeting app with their bank account, credit card, and investment platform, providing a unified dashboard where they can track their entire financial portfolio. Some finance apps also integrate with tax preparation services, insurance providers, and even payment platforms like PayPal and Venmo, making it easier to manage all financial tasks in one place.

This level of integration creates a cohesive financial management experience, reducing the complexity of managing multiple accounts and services. In the future, we can expect even greater interoperability between finance apps and other financial services, further simplifying personal and business finance management.

8. Rise of Cryptocurrencies and Blockchain Technology

The rise of cryptocurrencies and blockchain technology is another reason finance apps are becoming the future of digital financial management. With growing interest in decentralized finance (DeFi) and digital assets, finance apps are increasingly incorporating features that allow users to buy, sell, and store cryptocurrencies directly within their platforms.

Many finance apps now offer crypto wallets, real-time price tracking, and even educational resources for users interested in blockchain technology and digital currencies. As cryptocurrency adoption continues to grow, finance apps will play a pivotal role in bridging the gap between traditional finance and decentralized finance, making them essential tools for managing a wide range of financial assets.

Conclusion

finance apps are transforming how we manage our money, making it easier and more efficient. With their advanced features and user-friendly design, they help users take control of their finances. At Appic Softwares, we focus on developing innovative finance applications that meet the changing needs of users. Join us in embracing the future of digital financial management!

1 note

·

View note

Text

Unlock the future of your finances! Dive into our latest article exploring evolving fintech trends and discover how financial apps are morphing to make your money work smarter. 📲 From AI advisors to mobile banks, the future is at your fingertips. Are you ready to leap into the new era of financial empowerment?

2 notes

·

View notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#mobile app#mobile banking apps in india#e banking#premium mobile banking#kyc bank account#digital banking india#upi application#mobile finance app#payment bank#bank account check#paise check karne wala app#online money transfer to mobile number#upi app#account check karne wala app#best fd rates in bank#bank balance app download#bank balance app#bank balance check karne wala app#check my bank balance

0 notes

Text

This article helps you to navigate the world of digitalization in banking and financial institutes, revamping the banking experience. So, let’s dive into it. Enjoy your reading!

0 notes

Text

Who are the ideal candidates for a zero balance account?

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#upi application#mobile finance app#payment bank#bank account check#debit card online apply#bank fd rates#account check karne wala app#bank balance app download#paisa check karne wala app#check bank account balance#bank balance check karne wala app#check my bank balance#bank balance enquiry app

0 notes